Prices

Maersk and Hapag push up Asia rates

Maersk and Hapag push up Asia rates

https://container-news.com/maersk-and-hapag-push-up-asia-rates/

Maersk Line and Hapag-Lloyd have announced rate increases out of Asia to a number of destinations in North America and Africa.

In the first instance, the carrier will apply higher rates from Pakistan, United Arab Emirates (UAE) and the Indian Subcontinent to North America, effective from 1 November.

| Origins | Destinations | Cargo Type | 20DC / 40DC | 40High /40HREEF / 45HDry | Effective date |

|---|---|---|---|---|---|

|

Pakistan, UAE

and Indian sub-continent |

United States and Canada

|

DRY/REEF

|

US$400

|

US$400

|

1 November

|

Hapag-Lloyd has also announced a new general rate increase (GRI) on the eastbound Pacific trades from East Asia to all US and Canadian destinations. The new GRI will apply for all dry, reefer, non-operating reefer, tank, flat rack and open-top containers and will take effect from 1 November.

East Asia to North America (USA and Canada)

- US$960 per all 20′ container types

- US$1,200 per all 40′ container types

In addition, the German carrier will implement increased rates for all cargo types from Middle East, which includes Arabian Gulf, India and Saudi Arabia, to West Africa, from 10 October, as follows:

- US$500 per 20‘

Last but not least, as of 5 October, the Hamburg-based firm has pushed up its rates for all cargo from the Indian Subcontinent (except for Nhava Sheva and Mundra) to East Africa as follows:

- US$100 per 20‘

The Raw Material of Rubber is Causing the Price of Gloves and Tires to Rise

https://www.bangkokpost.com/business/1995183/rubber-rising-on-glove-and-tyre-demand

Thailand is likely to see higher shipments of rubber, increasing 3.19% this year, because of rising demand for rubber gloves and auto tyres, as well as the government’s proactive approach to promote rubber exports.

Speaking after meeting on Thursday with the International Trade Promotion Department, Rubber Authority of Thailand and rubber cooperatives, Commerce Minister Jurin Laksanawisit said Thailand’s rubber products are expected to fetch 359 billion baht this year, 3.19% higher than 2019.

Natural rubber shipments are expected to drop by 5% to 122 billion baht by year-end.

“Global demand for rubber gloves and auto tyres keeps rising significantly because of the global economic recovery after lockdown measures to curb the virus are being relaxed,” he said.

Prices of rubber sheet, block, and latex have all risen from the same period of last year.

As of Sept 30, domestic raw rubber sheet prices were quoted at 56 baht per kilogramme, up from 35-38 baht per kg year-on-year, while the free-on-board (FOB) rubber smoked sheet prices were 63.15 baht per kg, up from 41 baht last year.

In the first eight months, shipments of rubber products rose 2.32% year-on-year to 235 billion baht, while natural rubber exports decreased by 28.7% to 65.7 billion.

Thailand is the world’s largest producer of natural rubber, making 4.8 million tonnes last year, with exports accounting for almost 4 million tonnes.

Thailand ranks fourth for exports of rubber products and processed rubber, trailing China, Germany and the US. Exports totalled US$11.2 billion last year, up 2%.

Key markets include the US, China, Japan, Asean and Australia, with automotive tyres accounting for 51% of the shipments, followed by synthetic rubber and rubber gloves at 19% and 11%, respectively.

The Commerce Ministry reported global demand for protective gloves is soaring in light of the pandemic, driving Thailand’s rubber glove exports to surge 38.5% year-on-year in the first seven months of 2020 to $959 million.

Key markets include the US, China, Japan and Britain.

In 2019, Thailand produced more than 20 billion rubber gloves, with exports making up 89% of total production.

Last year Thailand fetched $1.2 billion from rubber glove exports. The country was the third largest rubber glove exporter, trailing Malaysia and China.

Mr Jurin said the government is also committed to promoting domestic rubber consumption to comprise as much as 20% of the country’s production next year.

Sukatus Tarngwiriyakul, deputy governor of the Rubber Authority of Thailand, said the proportion of domestic rubber consumption is likely to stay at 16% this year, up from 15% last year, boosted mainly by the government’s para-soil cement road construction in 45 provinces nationwide and rubber barriers and guideposts.

Hartalega Stock Likely to Soar Because of the Nitrile Glove Shortage

Hartalega likely to benefit from nitrile glove shortage

https://www.thestar.com.my/business/business-news/2020/09/25/hartalega-likely-to-benefit-from-nitrile-glove-shortage

PETALING JAYA: There’s a worldwide shortage of nitrile gloves, and it could stretch for more than a year into the first half of 2022 due to a lack of raw materials.

This may lead to Hartalega Holdings Bhd, one of the world’s largest nitrile gloves producers, raising its average selling price (ASPs) “more aggressively” in the coming quarters, according to Maybank IB Research.

For the second quarter ending Sept 30, the research house expected Hartalega to increase its ASPs by 30% from the first quarter, and 40% to 50% in the third quarter.

“However, we estimate that Hartalega’s nitrile glove ASPs could still be 30% to 40% lower than some of its peers by end-2020.

“We raise our blended ASPs by 21%, 68%, 81% for the financial year ending March 31,2021 (FY2021), FY22 and FY23, respectively, ” Maybank IB said in a report yesterday.

For comparison, last week, Top Glove, the world’s largest glove manufacturer, expected a more moderate increase in the ASPs for nitrile gloves.

It pointed out that the ASPs for nitrile gloves is currently US$70 per 1,000 pieces and is expected to increase by 30% in October and 15% in November. Top Glove expected another 10% in glove prices from November onwards.

On the back of the higher selling price of gloves in the near term, Maybank IB has raised its earnings estimate on Hartalega by 27% in FY21,125% in FY22 and 267% in FY23.

It has maintained its target price on Hartalega to RM20.60 per share as it lowers its 2021 price-earnings ratio to 14 times from 27 times, given that Hartalega’s earnings may taper in FY23 due to more new supply coming into the market.

“Hartalega is now our top pick for its share price as it lagged behind its big-cap peers. Its ASPs may also catch up with its peers, ” Maybank IB said.

The research house said a portion of the nitrile gloves demand has switched to latex and PVC gloves (due to shorter waiting time and lower ASPs).

However, the bulk of the demand, especially from the United States may remain sticky for nitrile gloves given its protein-free characteristic and superior quality.

“Also, new nitrile glove capacity is constrained by the shortage of NBR supply and glove moulds. As such, the nitrile gloves shortage could persist into the first half of 2022 and Hartalega could be a prime beneficiary for it is the most nitrile-centric player and has the biggest exposure to the US market at about 50% of sales, ” it said.

Maybank IB added that the gross margin of nitrile gloves could be six to eight percentage points higher than that of latex and PVC gloves.

Shares in Hartalega closed almost 10% higher to RM15.90 apiece yesterday.

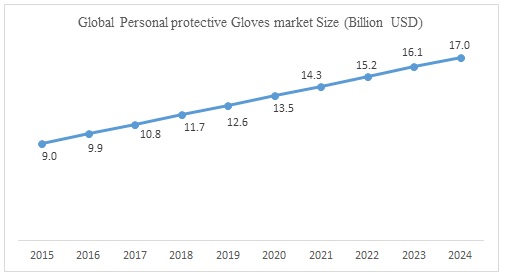

The Malaysian Rubber Glove Manufacturers Association in July projected global glove demand to grow 20% to 330 billion pieces in 2020, from 298 billion pieces last year.

Malaysia, the leading glove producer in the world, is expected to export 220 billion pieces of gloves valued at RM21.8bil this year compared with 170 billion pieces worth RM17.4bil in 2019.

World Health Organization (WHO) Estimates Manufacturing Must Increase by 40% to Meet Demand

World Market Outlook for the Disposable Gloves and Materials Markets 2020-2025: The World Health Organization Estimates Manufacturing Should be Increased by 40% to Meet Demand

https://www.globenewswire.com/fr/news-release/2020/09/23/2098003/0/en/World-Market-Outlook-for-the-Disposable-Gloves-and-Materials-Markets-2020-2025-The-World-Health-Organisation-Estimates-Manufacturing-Should-be-Increased-by-40-to-Meet-Demand.html

The COVID-19 pandemic spreading across countries and regions has caused a huge impact on people’s lives. Starting as a health crisis, it also poses serious threats to the global economy. The outbreak of COVID-19 has led to a surge in demand for disposable gloves worldwide. The pandemic has spurred a rush for protective equipment including gloves, with stores running out of them. With the increased infrequent visits to hospitals and other medical organizations, the healthcare sector is witnessing higher usage of disposable gloves than ever in the past. The coronavirus has slowly spread from China to worldwide, with the U.S. and Europe being the hotspots.

There was a shortage in supply, as the demand surpassed the production for disposable gloves and hospitals were running out of gloves. As the pandemic began, many consumers panic ordered, leading to the deficit. Frontline doctors and nurses had to face shortages to an extent that they had to re-use disposable gloves, risking the lives of patients and themselves.

Surging demand, partially joined with panic buying, hoarding, and misuse of gloves amid the COVID-19 pandemic has disrupted global supplies. The rise in gloves demand has depleted stockpiles, triggered significant price increases, and led to production backlogs of many months in fulfilling orders.

WHO (The World Health Organization) shipped millions of examination gloves to various countries. However, supplies are depleting rapidly owing to increasing COVID-19 cases. To meet rising global demand, the WHO estimates that the industry must increase manufacturing by 40% and urges governments to act quickly to boost supply. WHO suggests that governments should develop incentives for the industry to ramp up production of gloves.

Malaysia, which is the world’s largest glove manufacturer, reported a surge in orders from all over the world, especially from the U.S. and Europe. Many disposable manufacturers increased their production capacity, and few are in the process of expansions to cater to the increasing demand. From February 2020 to June 2020, manufacturers worked at full capacity but still were not able to meet the need.

Disposable gloves are used in varied applications, including medical, cleanrooms, food and beverage, and industrial and chemical. A cleanroom includes manufacturing of pharmaceuticals, biotechnology, integrated circuits, CRT, LCD, OLED, and micro-LED displays, among others. In these environments, extremely low levels of particulates must be maintained.

The Glove Shortage will be Far Worse than the Mask Shortage

The upcoming nitrile glove shortage could be way worse than the mask shortage

https://www.newstimes.com/shopping/article/what-do-do-about-upcoming-nitrile-glove-shortage-15557731.php

In the face of the Covid-19 pandemic, a nitrile glove shortage may not seem as dire as a mask shortage. After all, no virus can “drill through the skin on your hand,” and masks are still the best safety precaution for most people.

However, these gloves are still a necessity for medical professionals, tattoo artists, food servers, and mechanics. Plus, they have various at-home uses including gardening, cleaning, and safety precautions for the immunocompromised. Right now, our supplies are dwindling — and the United States currently has no domestic manufacturers.

Outside of professional standards, nitrile gloves are sought at the consumer level for their strong resistance to puncture, protection against corrosion and chemicals, and hypoallergenic qualities — though some people are allergic, it’s far less common than an allergy to latex or other glove-making materials. We’ve also previously recommended them for gardening, and they’re great for working with fiberglass and harsh cleaning chemicals.

In other words, not everyone needs gloves — but the people who do need gloves are likely to need nitrile gloves. And they’re only going to get harder to find.

“The big problem with the nitrile glove space is that the barrier to entry is so great,” says Sean Kelly, Chief Procurement Officer for PPE of America. “For surgical masks, also known as 3-ply masks, for $150,000 you can get a machine to make them and you’re in business. … nitrile glove manufacturing is very complex. The raw materials are very difficult to access in some parts of the world.”

Right now, the only domestic manufacturer of nitrile gloves is The Showa Group with a factory in Fayette, Ala. And when it comes to amateur glove-making, well, that simply doesn’t exist.

In other words, the deluge of consumer-grade masks we’ve seen — from fashion companies to individuals starting their own side-hustles on Etsy — that won’t happen with nitrile gloves. And there’s already starting to be an impact.

“Before Covid, you could buy a box (of nitrile gloves) for $3 – $6,” says Kelly. “Go on Amazon now, and you’ll see the average price is $19 – $25, which is ludicrous.”

Exacerbating the problem is the lack of domestic manufacturers, as well as increasing pressure on our foreign providers: In July, the US banned two subsidiaries of the world’s largest glove manufacturer, citing “reasonable evidence of forced labor in the manufacturing process.”

Another problem is fraud, which is especially malignant during the desperation of a public health crisis. Such fraud was a huge problem in the early days of the pandemic: leading N95 mask manufacturer 3M was investigating 4,000 reports of N95 fraud in July, and the Bay Area faced consumer-level fraud in April.

While the biggest problems in procuring nitrile gloves will largely be happening at a corporate, wholesale level, the issues will trickle down to consumers quickly.

“I spoke to a senior buyer in a hospital, and they said that they had literally run out of large nitrile gloves. The glove situation is different with the masks, because with or without Covid, a lot of people need these gloves, but with Covid, they need them more than ever.”

Transpacific to the West Coast Nudging $4000 per Container for Nitrile Gloves

Maersk cancels all blanked sailings on the transpacific

https://splash247.com/maersk-cancels-all-blanked-sailings-on-the-transpacific/

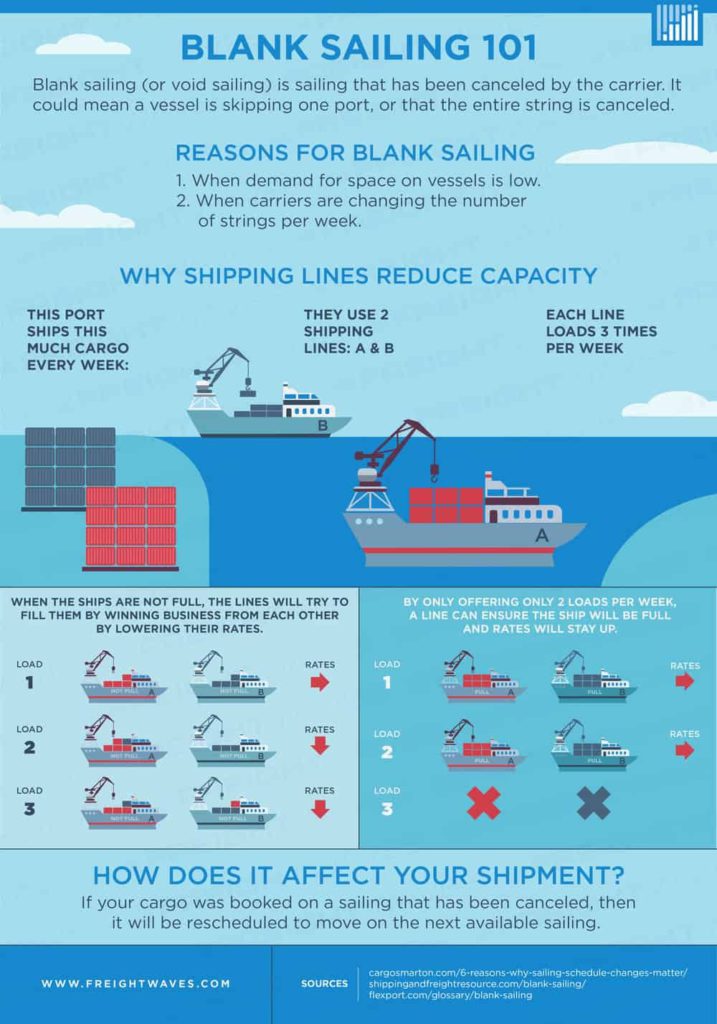

Citing the strong import volumes seen in North America seen over the past 60 days, which it anticipates to carry on until at least November, Maersk, the world’s largest containerline, has announced it is cancelling all blanked sailings on the transpacific.

The record spot rates seen on the transpacific to the west coast in recent weeks, nudging $4,000 per container, have sparked alarm in China, South Korea and the US. The Shanghai Containerized Freight Index (SCFI) today reported rates edging again this week to $3,867 per feu.

“If it holds cargo or floats, it will soon be on its way to the US of A,” quipped one container shipping analyst in conversation with Splash today.

Beijing has stepped in over the past week demanding carriers add more capacity on the trade lane and ease price increases, with both state-run Cosco – and its affiliate OOCL – and Maersk agreeing to the Chinese government measures. The Federal Maritime Commission (FMC) in Washington also met this week to take a look at the situation.

“If there is any indication of carrier behavior that might violate the competition standards in section 6(g) of the Shipping Act, the Commission will immediately seek to address these concerns with the carriers. If necessary, the FMC will go to federal court to seek an injunction to enjoin further operation of the non-compliant alliance agreement,” the commission warned,” the FMC stated.

The Maersk customer advisory predicted the current strong markets would remain through to November, and possibly January in the run up to Chinese New Year.

Other carriers are expected to follow Maersk’s lead. The Danish company added in yesterday’s advisory it was reactivating idle capacity, sourcing more leased containers and expediting empty boxes back to Asia to handle the rush.

The records tumbling on the transpacific have created the widest gap on record between short and long term contract freight rates on the tradelane, shipowning organisation BIMCO noted this week.

“The stars are now aligned for carriers to achieve higher long term contract rates,” BIMCO suggested pointing to data from Xeneta that shows there’s now a record $2,400 difference per feu on short and long term contracts for boxes bound to North America.

A significant rise in container volumes into the San Pedro Bay ports of Long Beach and Los Angeles on the US west coast has pushed imports up by 13% and 18% respectively in August, compared to the same month last year. The rise stands in contrast to an average of 17% decline in container volumes in February, March and May this year.

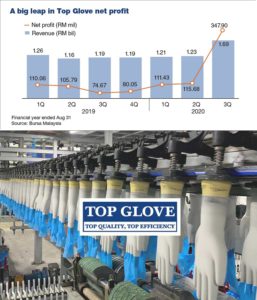

Guidance for Glove Price Increases: Top Glove 30% in October and 15% in November

In August the glove manufacturers connected to this website provided guidance that the prices would be going up 10 to 15 percent every two weeks through May of 2021. Now that story is coming true. 30% in October and 15% November.

https://www.theedgemarkets.com/article/asp-nitrile-gloves-grow-30-october-and-15-november-says-top-glove

KUALA LUMPUR (Sept 17): Top Glove Corp Bhd has guided that the average selling price (ASP) for its nitrile gloves will increase by 30% in October, 15% in November and perhaps another 10% after November, as outlook for the group and the glove industry remains promising.

As of this month, the group’s ASP for nitrile gloves stands at US$70 per 1,000 pieces. Nitrile gloves production occupied almost 60% of the total group’s production, while the remainder comprised latex and vinyl gloves.

Top Glove chairman Tan Sri Lim Wee Chai further guided that the increase in the ASP of gloves due to the virus-driven demand surge should last for at least another year, due to the shortage of raw materials, in particular for nitrile gloves.

It goes without saying that 2020 has been a challenging year for businesses all around the world, with the pandemic being the key factor to this. Malaysian companies are experiencing the same effect, and in many ways too.

The group’s ASP for nitrile gloves in its fourth quarter ended Aug 31, 2020 (4QFY20) has more than doubled (103%) from 3QFY20, while on a year-to-year basis, it has increased by 114%. The ASP for nitrile gloves for FY20 as a whole is up 31% from FY19’s.

Lim said glove demand is estimated to grow by 20% per annum in 2020, 25% in 2021 and 15% in 2022, compared with the 10% annual growth seen before the pandemic outbreak.

The group also echoed what its peer Hartalega Holdings Bhd said previously, that the surge in global demand — anticipated to be 200 billion pieces by 2022 — will outstrip the estimated new supply coming in from major manufacturers in Malaysia.

“If you want to build a nitrile latex raw material factory, it may take two to three years. To build a glove factory, it may take one to two years. So, it means supply will not be able to increase so fast to meet demand,’ Lim explained.

And notwithstanding news of several promising vaccines in the pipeline, Top Glove expects glove demand to remain strong, as vaccines take time to produce.

Lim, meanwhile, said it makes more sense for the world’s largest rubber glove manufacturer to grow its business organically now, rather than via mergers and acquisitions (M&A), as the latter tend to be more expensive as the industry is now doing well.

“For merger and acquisition (M&A) during good times, the selling price of a glove factory or company will be high. So the chances of M&A is not so likely… Investors don’t like to pay very high prices to acquire a glove company, as we can build our own at a much lower cost, and with newer machines,” Lim told a virtual press conference held in conjunction with the announcement of the group’s latest quarterly and annual results.

Having said that, Lim said the group does not discount the possibility of engaging in M&A activities, given its strong balance sheet, with a net cash of RM2.34 billion as at Aug 31.

“There’s always a possibility…less chance (of something happening) doesn’t mean no chance at all…So, we need to stand by some money for acquisitions,” he added.

The group has also earmarked RM8 billion for the next six years, from FY21 to FY26, to increase its annual glove production capacity by 100 billion pieces — up from its current 85.5 billion pieces per annum.