Maersk cancels all blanked sailings on the transpacific

https://splash247.com/maersk-cancels-all-blanked-sailings-on-the-transpacific/

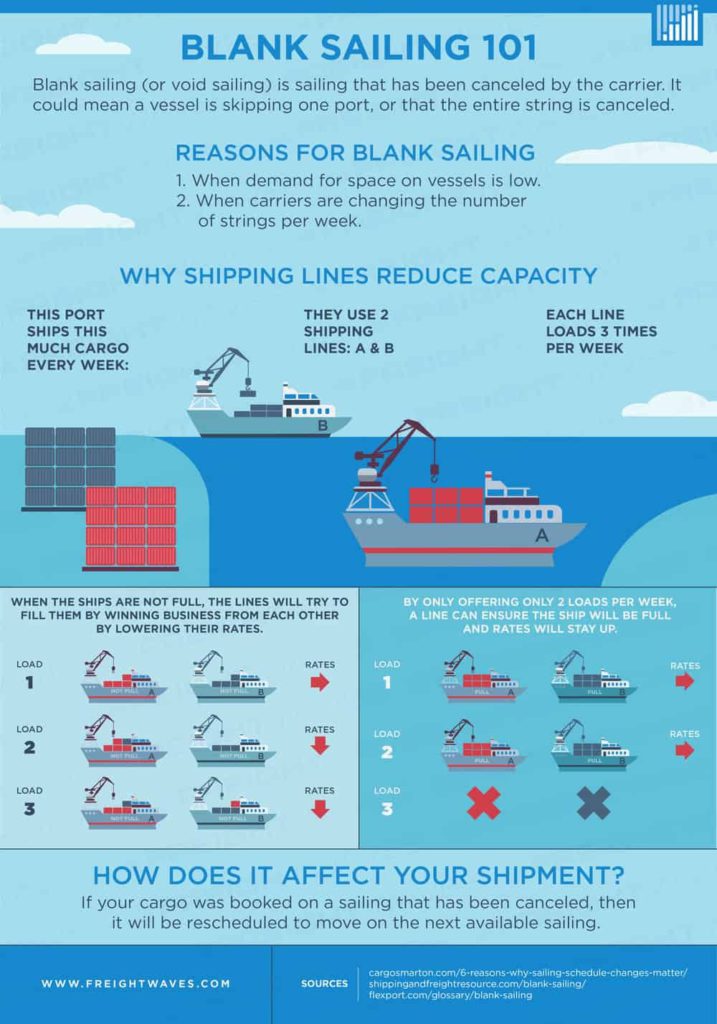

Citing the strong import volumes seen in North America seen over the past 60 days, which it anticipates to carry on until at least November, Maersk, the world’s largest containerline, has announced it is cancelling all blanked sailings on the transpacific.

The record spot rates seen on the transpacific to the west coast in recent weeks, nudging $4,000 per container, have sparked alarm in China, South Korea and the US. The Shanghai Containerized Freight Index (SCFI) today reported rates edging again this week to $3,867 per feu.

“If it holds cargo or floats, it will soon be on its way to the US of A,” quipped one container shipping analyst in conversation with Splash today.

Beijing has stepped in over the past week demanding carriers add more capacity on the trade lane and ease price increases, with both state-run Cosco – and its affiliate OOCL – and Maersk agreeing to the Chinese government measures. The Federal Maritime Commission (FMC) in Washington also met this week to take a look at the situation.

“If there is any indication of carrier behavior that might violate the competition standards in section 6(g) of the Shipping Act, the Commission will immediately seek to address these concerns with the carriers. If necessary, the FMC will go to federal court to seek an injunction to enjoin further operation of the non-compliant alliance agreement,” the commission warned,” the FMC stated.

The Maersk customer advisory predicted the current strong markets would remain through to November, and possibly January in the run up to Chinese New Year.

Other carriers are expected to follow Maersk’s lead. The Danish company added in yesterday’s advisory it was reactivating idle capacity, sourcing more leased containers and expediting empty boxes back to Asia to handle the rush.

The records tumbling on the transpacific have created the widest gap on record between short and long term contract freight rates on the tradelane, shipowning organisation BIMCO noted this week.

“The stars are now aligned for carriers to achieve higher long term contract rates,” BIMCO suggested pointing to data from Xeneta that shows there’s now a record $2,400 difference per feu on short and long term contracts for boxes bound to North America.

A significant rise in container volumes into the San Pedro Bay ports of Long Beach and Los Angeles on the US west coast has pushed imports up by 13% and 18% respectively in August, compared to the same month last year. The rise stands in contrast to an average of 17% decline in container volumes in February, March and May this year.

Order Inquiry

Thinking about an order? What do you have in mind? What might your buyer be looking to buy?

Production Opportunities with Factory Prices

These prices do not include a 10% commission. Commissions may be structured as a per box of 40 to 75 cents or with a flat 10% commission split into 3rds. Brokers are welcome to ask for quotes. MOQ is the total over a period of time. This website is the only seller intermediary. The whole broker buyer intermediary box is wide open. (This website was started with one purpose, to promote the list below. We have other things going, but the list below is your best option for real product with reliable SGS reports and service.)